Business

checking

built for you.

Apply in minutes for no monthly or

overdraft fees and unlimited transactions.BVSUP-00043

Bluevine is a financial technology company, not a bank.

Bluevine deposits are FDIC-insured through Coastal Community Bank, Member FDIC.

Small business banking

with big benefits.

Save on fees, earn interest, and set your business up for success with an online

business checking account.

No monthly fees

Don’t worry about monthly or

overdraft fees.

No minimum balances

Open an account with no

minimum deposit required.

Unlimited transactions

Make all the deposits or payments

you need with no limit on your

number of transactions.BVSUP-00043

High-yield

interest

Earn 2.0% interest on your

balance up to and including

$250,000 if you meet a monthly

activity goal.BVSUP-00065

Our most active customers save $500/year in fees.

Actual annual savings are based on customer account activity.BVSUP-00080 See how Bluevine compares to other business checking accounts.

See full fee schedule

You could earn up

to $5,000/year in interest.

Earn 2.0% interest on balances up to and including $250,000 if you meet a monthly activity goal.BVSUP-00065

See monthly activity goals

Better business checking,

made easy.

Thoughtfully designed for a simple, all-in-one online banking experience.

Mobile check

deposit

Easily deposit checks from your phone with monthly limits 2x the industry average.BVSUP-00088

Bill Pay that saves

you time

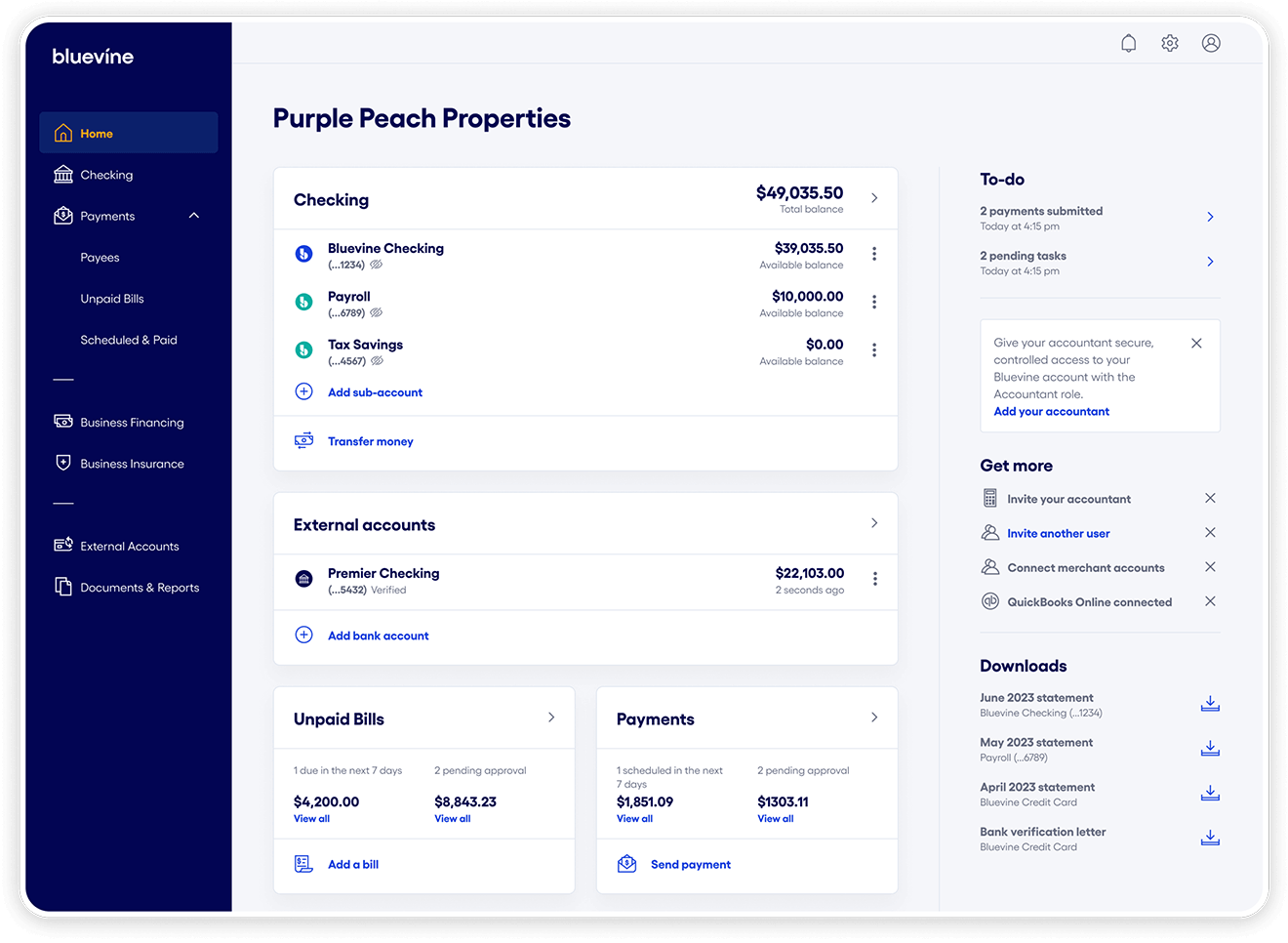

Easily make domestic payments or send money internationally, all from one dashboard.BVSUP-00074 Plus, sync with QuickBooks® Online.BVSUP-00056

Account access

for your team

Securely share access with your team or accountant by giving each a dedicated login for a smooth online banking experience.BVSUP-00076

Multiple

sub-accounts

Organize your finances the way you want by adding up to five sub-accounts with designated account numbers.BVSUP-00053

Take your payments global.

Extend your business reach with international payments to 32

countries in 15 currencies.BVSUP-00074

Steps we take to protect your

business bank account.

With Bluevine, your business checking account has advanced security

measures that keep your money safe and your information protected.

Two-factor authentication so only you and authorized users can access your account

Data encryption to keep

your information safe

Text alerts if we notice any suspicious activity or debit transactionsBVSUP-00084

FDIC insurance on Business Checking balances up to and including $250,000 through Coastal Community Bank, member FDIC

See why our customers love Bluevine.

“I searched far and wide to find an effective and simple business banking solution that met my business needs and I found that in Bluevine.

Their integrations and no fee structure were selling points for me.”

– Logan P, LP Creative Media

Read the storySee why our customers love Bluevine.

Online business checking FAQs

A business checking account is a bank account designed specifically for businesses to manage their finances. It allows business owners to deposit and withdraw money, make payments, and keep track of their transactions.

Qualifying for a business checking account typically requires legal documentation, like a business license or articles of incorporation. When starting your application, make sure you have your identification readily available. Depending on the institution, you may also need to meet certain requirements, like minimum deposits or credit scores.

Bluevine does not have a minimum balance requirement. However, some business checking accounts do require a minimum deposit.

A traditional checking account is designed for personal use, while a business checking account is designed for business use. Business checking accounts often come with additional features and services that are specifically tailored to meet the needs of businesses.

To open a business checking account, you will typically need to provide documentation that verifies your business's legal existence, such as a business license or articles of incorporation. You will also need to provide identification and may need to meet other requirements such as minimum deposits or credit scores.

Mixing your personal and business finances could open you up to personal liability, so it’s a good idea to separate accounts for each. Opening the right business checking account to manage your LLC's finances can help you save on monthly fees and even give you the opportunity to earn interest on your operating balances.

Yes, you will need an Employer Identification Number (EIN) from the IRS to open a business bank account.

Yes! Some banks may have restrictions on how much you can deposit in a given day or month. With Bluevine Business Checking, you can easily use mobile check deposit to conveniently deposit checks from your phone—at 2x the average monthly limit.

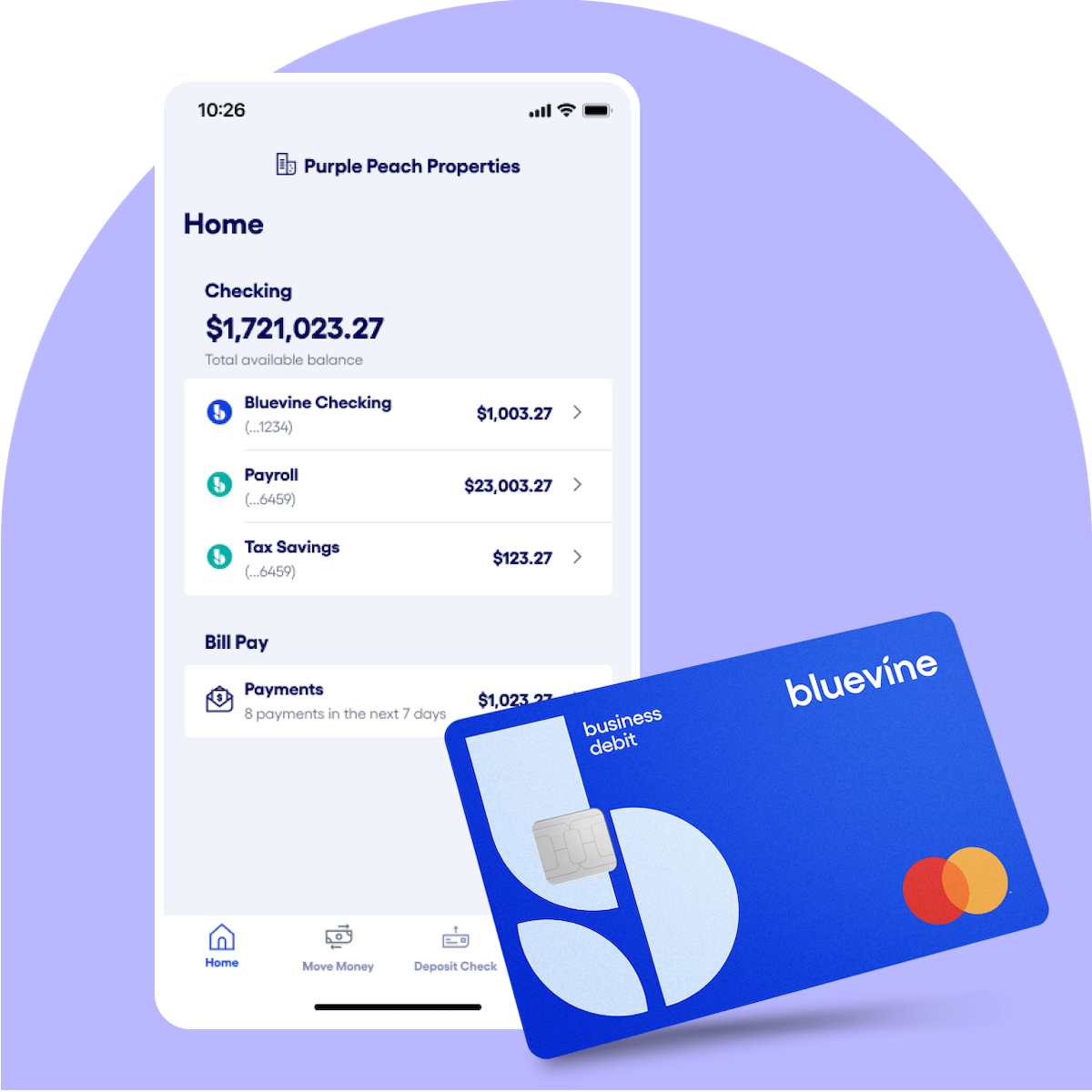

Yes, your Bluevine Business Checking account comes with the convenient and secure Bluevine Business Debit Mastercard®, which rewards you for everyday business purchases. Learn more about your debit card’s benefits.

Set up your Bluevine account

with ease.

Helpful guides to show you how to apply and get started with Bluevine Business Checking,

plus all the great features we’ve built specifically for small businesses.

Ready to apply for

Bluevine Business

Checking?

Submit your application in just a few minutes.BVSUP-00006